Has Been Sold to

July 2025

We deliver superior results for our clients resulting in industry awards for excellence and long-lasting relationships with leading strategics, Growth Equity, and Private Equity investors.

Our team has sector specific knowledge, deep experience, and a track record of success. We are experts in understanding the trends and market participants and leverage this to achieve success for our clients.

Leonis is a full-service advisor to entrepreneurs and their businesses. We craft highly calibrated solutions to achieve our clients’ needs.

View all Transactions

View all Transactions

July 2025

March 2025

February 2025

February 2025

October 2024

October 2024

October 2024

September 2024

June 2024

March 2024

February 2024

February 2024

December 2023

November 2023

October 2023

October 2023

August 2023

July 2023

June 2023

April 2023

December 2022

December 2022

December 2022

November 2022

November 2022

November 2022

September 2022

June 2022

June 2022

May 2022

April 2022

January 2022

January 2022

November 2021

November 2021

November 2021

November 2021

October 2021

September 2021

September 2021

September 2021

August 2021

May 2021

April 2021

March 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

July 2020

May 2020

April 2020

March 2020

March 2020

February 2020

February 2020

View all News and Research

View all News and Research

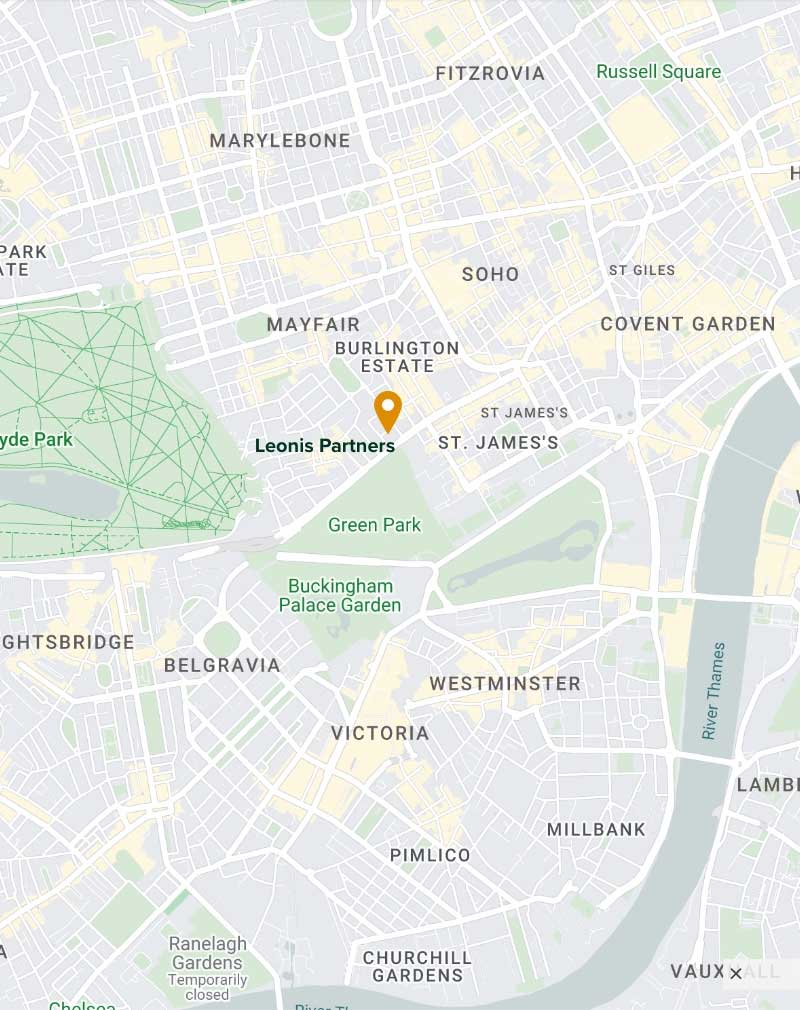

Interested in having a conversation

with our team members?

Drop us a line

Drop us a line